Financial Services & Commerce

Retailers Look to Policymakers to Navigate the Post-Penny Era

December 9, 2025 | Katherine Tschopp

October 9, 2024 | Katherine Tschopp

Key Takeaways:

Both state and federal legislators have targeted price gouging, minimum markup, and below-cost issues in price control legislation to protect consumers in recent years. In 2024, there has been a noticeable shift in legislation from managing actual reasonable prices of goods to determining fair price consistency and transparency practices by retailers.

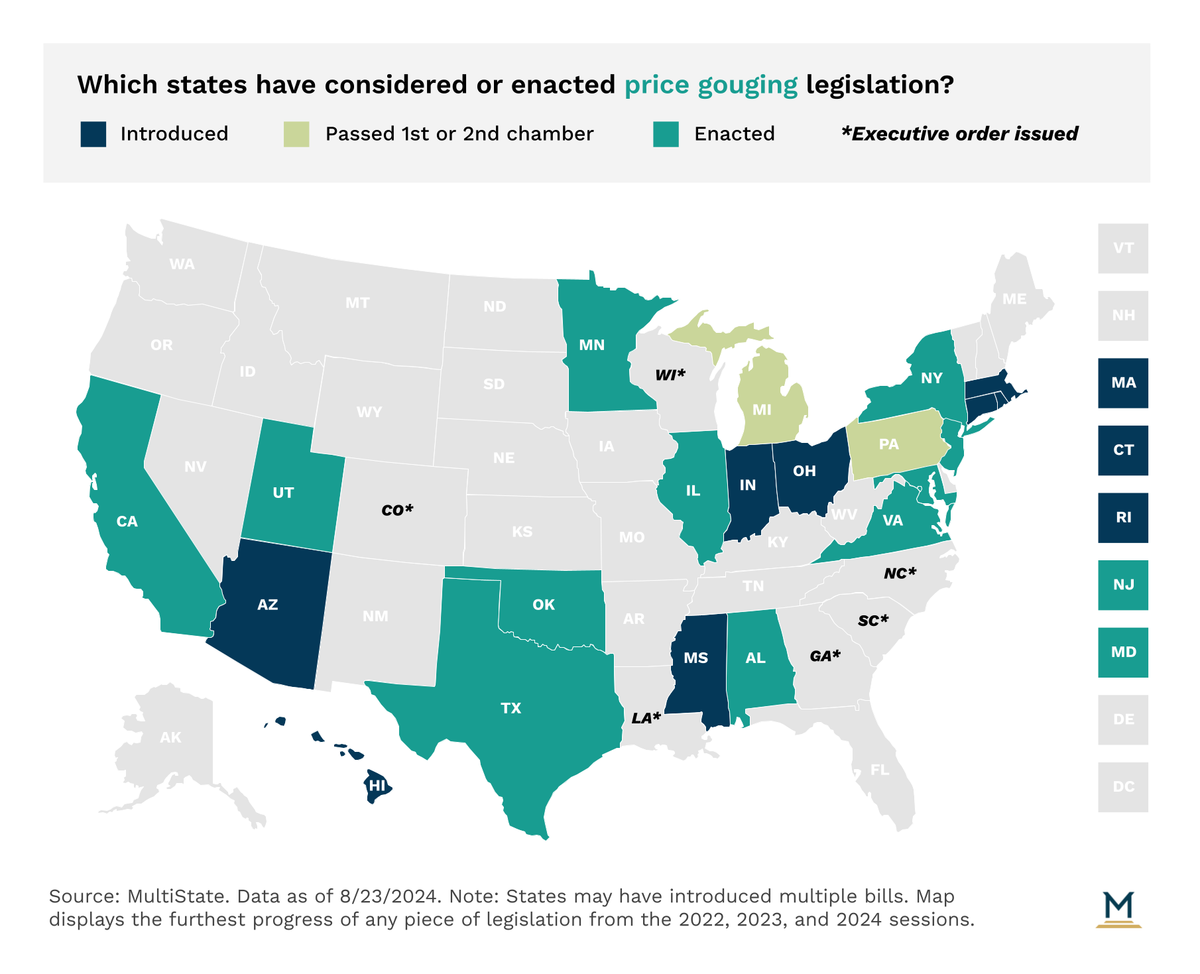

The excessively high charging of in-demand necessities and limited stock of goods caused price gouging to become a critical legislative focus in 2022 and remains a predominant issue in price control legislation in 2024. Between 2022 and 2024, 22 states and DC introduced price gouging prohibitions, of which 11 states and DC successfully enacted these measures. Price gouging restrictions spanned a variety of products and industries, but the majority had the same underlying theme: preventing unreasonably excessive pricing during times of emergency (VA HB 1301, UT SB 73, TX SB 401). Toward the end of 2023, price gouging bills began to steer away from COVID-related provisions and apply unconscionable pricing restrictions to sales of necessities like gasoline (NJ SB 2818 and PA HB 135), infant formula (IN HB 1014), and prescription drugs (MA SB 783, MN SF 168, and NY SB 608).

In addition to legislative efforts, several states — Colorado, Georgia, Illinois, Louisiana, North Carolina, South Carolina, and Virginia — experienced increased gubernatorial activity in 2022, with governors issuing executive orders to enforce or extend price-gouging policies in response to public health and weather emergencies. Wisconsin Governor Tony Evers (D) took a different approach, using his executive power to ban the sale of infant formula at excessively high prices during the national formula shortage.

In 2023 and 2024, Congress introduced several pieces of price-gouging legislation, although progress beyond the initial bill introduction has been limited. Some bills (e.g., US S 3803) cover a broad scope and would prohibit overall price gouging. Others (e.g., US HR 8493) would establish a national price-gouging task force. More often, though, legislation has aligned with state efforts demonstrating ongoing pricing concerns in critical areas like energy, transportation, and healthcare. Bills introduced addressed the price gouging of natural gas after disasters (US HR 2596), gasoline (US S 355), and drugs and medications (US S 2044).

Lawmakers have introduced narrowly tailored, product-specific minimum markup and below-cost bills since 2022, most of which concern alcoholic beverages. In Nebraska, a bill (NE LB 875) would have prohibited the sale of alcoholic beverages for off-premise consumption below cost. In Oklahoma, legislation (OK SB 71 and OK SB 284) would have eliminated the existing six percent markup on alcoholic beverages. And a Texas bill (TX HB 4685) would have further prohibited the sale of wine or liquor below cost. Republican lawmakers in Wisconsin introduced legislation that would have repealed the general minimum markup law forbidding the sale of any merchandise below cost, instead requiring a minimum markup for motor vehicle fuel, tobacco products, fermented malt beverages, liquor, or wine sales. Price control issues like minimum markup and below cost have decreased in prevalence, with only three states, Louisiana, Nebraska, and Wisconsin, introducing related legislation this year.

Party affiliation did not appear to play a role in below-cost bills relating to dairy products. Democratically led Minnesota introduced legislation to eliminate its existing below-cost prohibitions on the sale of dairy (MN SF 1867), while Louisiana unsuccessfully attempted to specify that the sale of milk or milk products below cost is not an unfair method of competition and prohibit price markup requirements for retailers in 2023 and a second time in 2024.

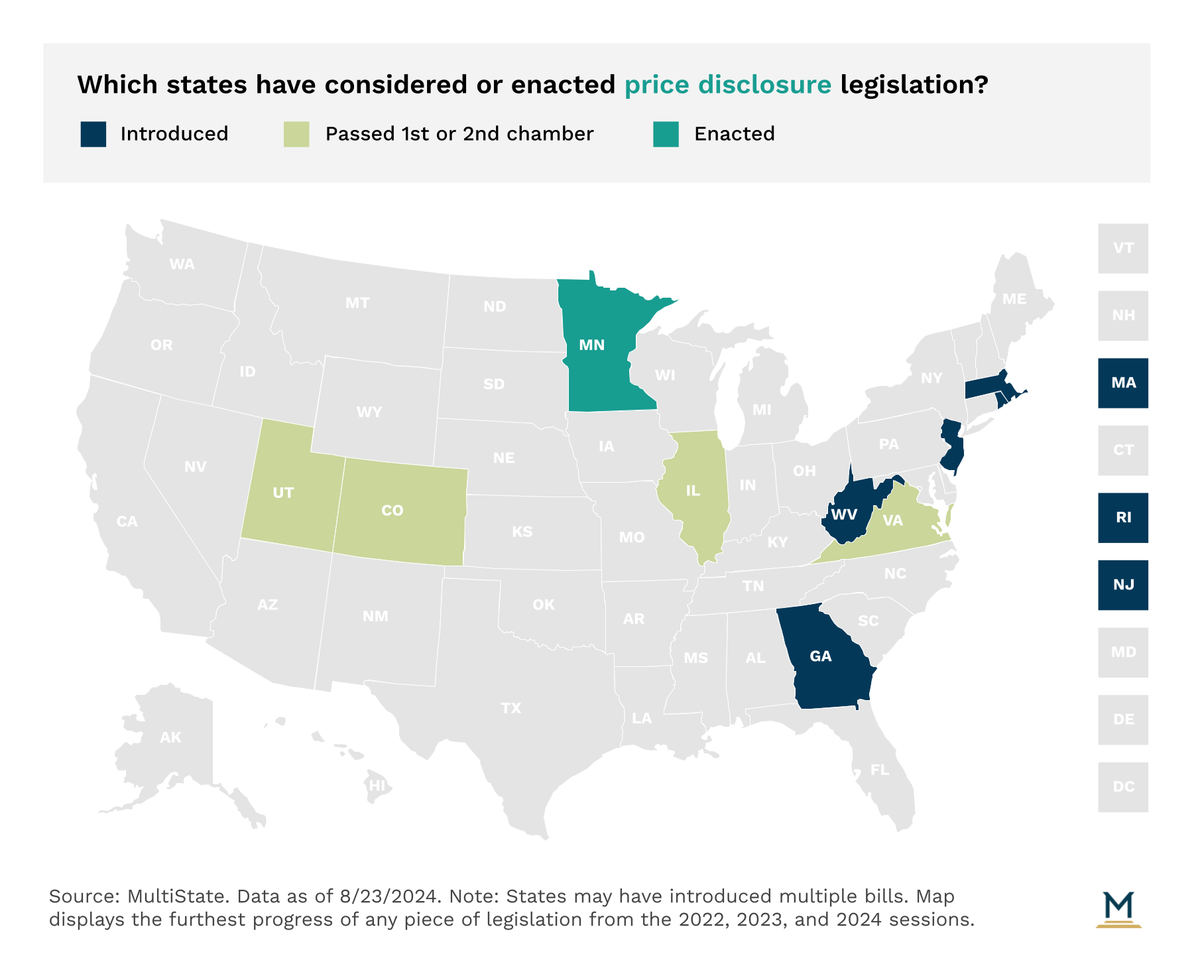

Careful attention to the cost of goods in recent years has accentuated extra fees and errors in retailer price consistency, prompting new legislative trends in 2024. In October 2023, California enacted a law (CA SB 478) making it a crime, beginning July 1, 2024, for any person or company to engage in specified false or misleading advertising practices, including the advertisement, display, or offer a price for a good or service that does not include all mandatory fees or charges other than taxes or fees imposed by a government on the transaction. Efforts to address hidden and junk fees increased in 2024, with several states following California’s lead, introducing similar bills requiring stores to display the total price of goods, including all taxes and fees, with non-compliance deemed an unfair trade violation as efforts to address hidden and junk fees increased. Bills in Colorado, Illinois, Utah, and Virginia have progressed past the initial legislative stages, and in May, Minnesota enacted its retail price disclosure bill (MN HF 3438).

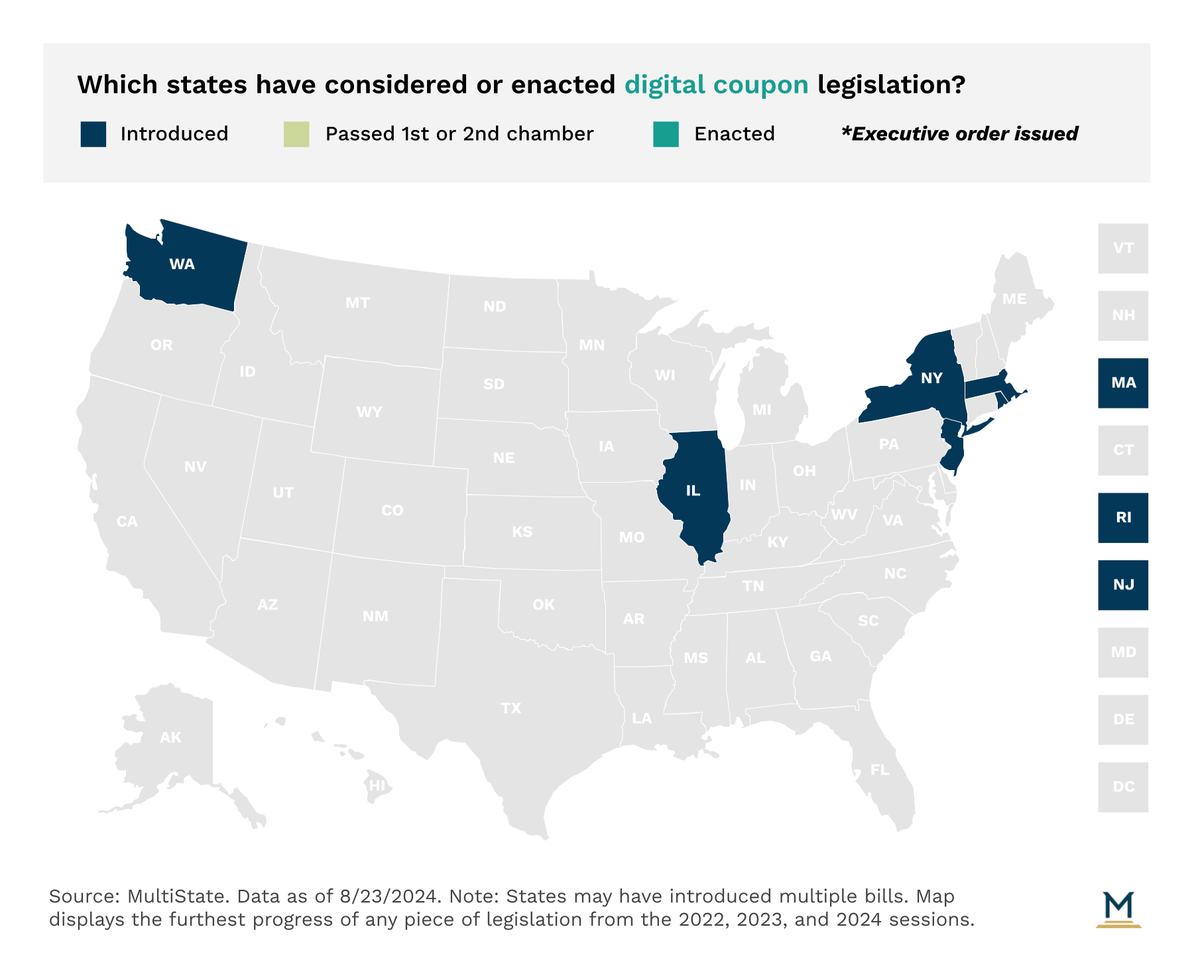

Another rising trend this year is price parity across internet and in-person purchases. With the rise of online platforms for deals and discounts, senior and low-income consumers — who may lack the skills or access to necessary technology — face difficulties accessing these offers, leading to New Jersey introducing novel digital coupon legislation in 2023. The bill (NJ SB 3573) would have required retailers to honor online discounts in physical stores and was quickly followed by the introduction of a similar bill in New York ( NY AB 6827), but the legislation did not advance in either state. New Jersey and New York legislators reintroduced similar bills again in 2024 joined by the introduction of additional legislation in Democratic trifecta states Illinois, Massachusetts, Rhode Island, and Washington. Proposals in Massachusetts (MA HD 4505) and Washington (WA SB 6265) went a step further, proposing that retailers must apply all online and in-store coupons at the point of sale regardless of whether the customer is eligible to receive member-only discounts through the retailer’s online platform.

MultiState’s team is actively identifying and tracking pricing issues so that businesses and organizations have the information they need to navigate and effectively engage. If your organization would like to further track pricing or other related commerce issues, please contact us.

December 9, 2025 | Katherine Tschopp

August 7, 2025 | Katherine Tschopp

April 4, 2025 | Bill Kramer