Transportation & Infrastructure

Automated Traffic Enforcement Bills Confront Privacy and Safety Debates (2025 Legislative Recap)

February 3, 2026 | Kerrie Zabala

July 8, 2024 | Bill Kramer

-682516-1200px.jpeg)

Key Takeaways:

Two long-term trends are converging, causing policymakers to send mixed signals to electric vehicle purchasers. First, as we’ve chronicled, the gas tax — i.e., the primary funding mechanism for transportation infrastructure over the past century — is doomed. A combination of unpopularity, inflation eating away at the tax rate, improving fuel efficiency, and a transition away from gas-powered vehicles means that gas taxes are no longer raising enough revenue to maintain our current roads and bridges, let alone pay for new construction.

That transition to electric vehicles (EVs) itself is the second important trend. In an effort to decarbonize our energy mix, policymakers spurred EV adoption through incentives and direct subsidies and continue to do so, most recently and broadly through federal laws like the IIJA (injecting $7.5 billion to help states build a national EV charging networks) and IRA (tax credits for new and used EVs). And individual states offer their own incentives for EV buyers.

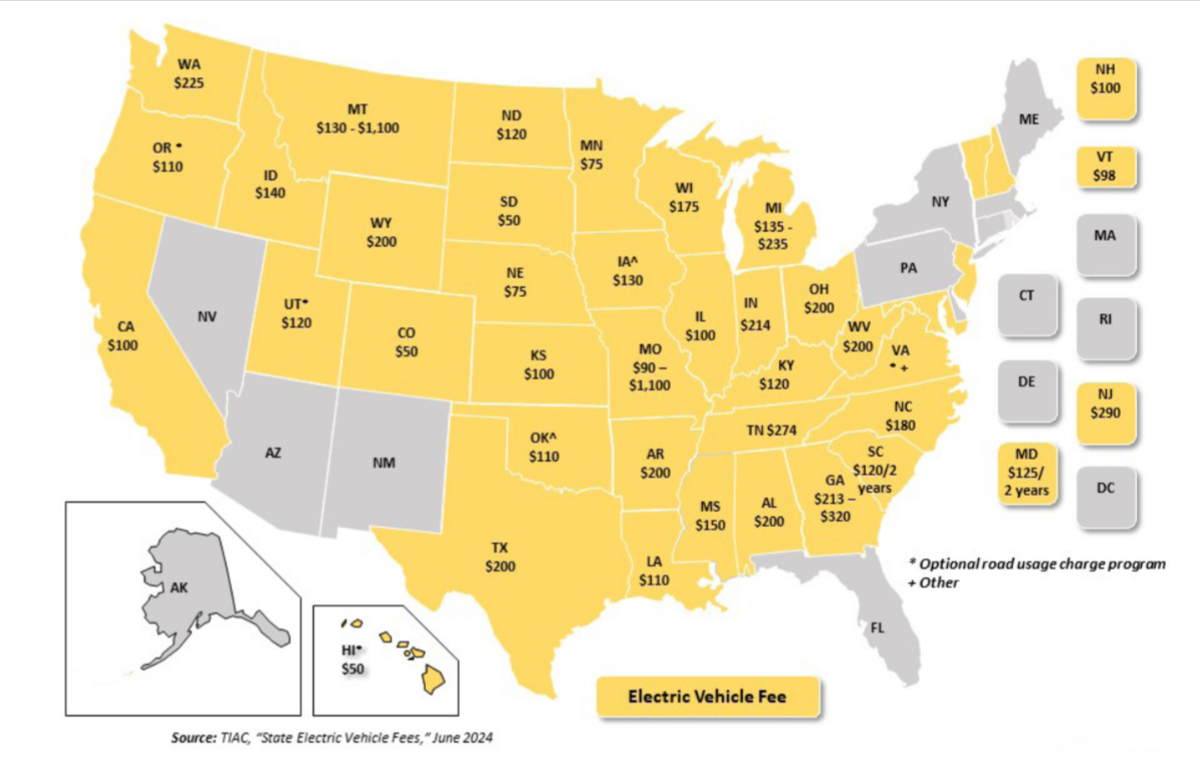

But today, while policymakers seek to encourage the EV transition, they’re faced with a dwindling budget to fund the roads and bridges that both gas-powered and electric vehicles need to get from A to B. And since EVs skip the pump altogether, EV drivers pay zero gas taxes. In response, most states have enacted special registration fees for EVs in order to make up the difference.

Image credit: Transportation Investment Advocacy Center.

Image credit: Transportation Investment Advocacy Center.

Currently, 38 states have enacted new registration fees for EVs to ensure all drivers contribute to the construction and maintenance of the transportation infrastructure they use. These extra fees range from $50 per year in Colorado, Hawaii, and South Dakota, to $290 in New Jersey. Most recently, Vermont Gov. Phil Scott (R) signed a bill to charge EV drivers an additional $89 registration fee starting next year. But as Sen. Tanya Vyhovsky (D) said during the debate over the fee in Vermont, adding a new fee for an activity the state wants to encourage could be counterproductive. “I have a concern that there may be people who would like to switch, and who have a deep desire to do something for the environment, that this fee will simply make that impossible for them.”

If you want more of something, subsidize it; if you want less of something, tax it. But transportation infrastructure needs to be funded, and the best way to fund it is through fees on those that use it, including EVs. Sen. Andrew Perchlik (D) points out, “We have a lot of incentives for electric vehicles on the purchase price that far, far far exceed the $89 that you’d be paying.” In a sense, since the federal subsidies for EV purchasers largely outweigh the registration fees, the federal subsidies are partly subsidizing state transportation trust funds. And in the case of Vermont, much of the new funding is going directly to building out EV charging stations in the state.

Although states have embraced new registration fees for EVs as a way to make up lost gas tax revenue, the dream of completely replacing the gas tax as the primary funder of the transportation infrastructure is still incomplete. Potential options include a miles traveled fee and even congestion pricing systems in large urban areas. But New Yorkers learned last week what a political hurdle major changes like these would take.

This article appeared in our Morning MultiState newsletter on June 11, 2024. For more timely insights like this, be sure to sign up for our Morning MultiState weekly morning tipsheet. We created Morning MultiState with state government affairs professionals in mind — sign up to receive the latest from our experts in your inbox every Tuesday morning. Click here to sign up.

February 3, 2026 | Kerrie Zabala

September 12, 2023 | Bill Kramer

-9b630e-400px.jpeg)

September 5, 2023 | Kim Miller