Technology & Privacy, Tax & Budgets, Health Care & Wellness

ICYMI: Major Emerging Legislative Trends in 2025 (Webinar Recap)

April 8, 2025 | Liz Malm

February 28, 2025 | Joseph R. Crosby, Andrew Jones

Key Takeaways:

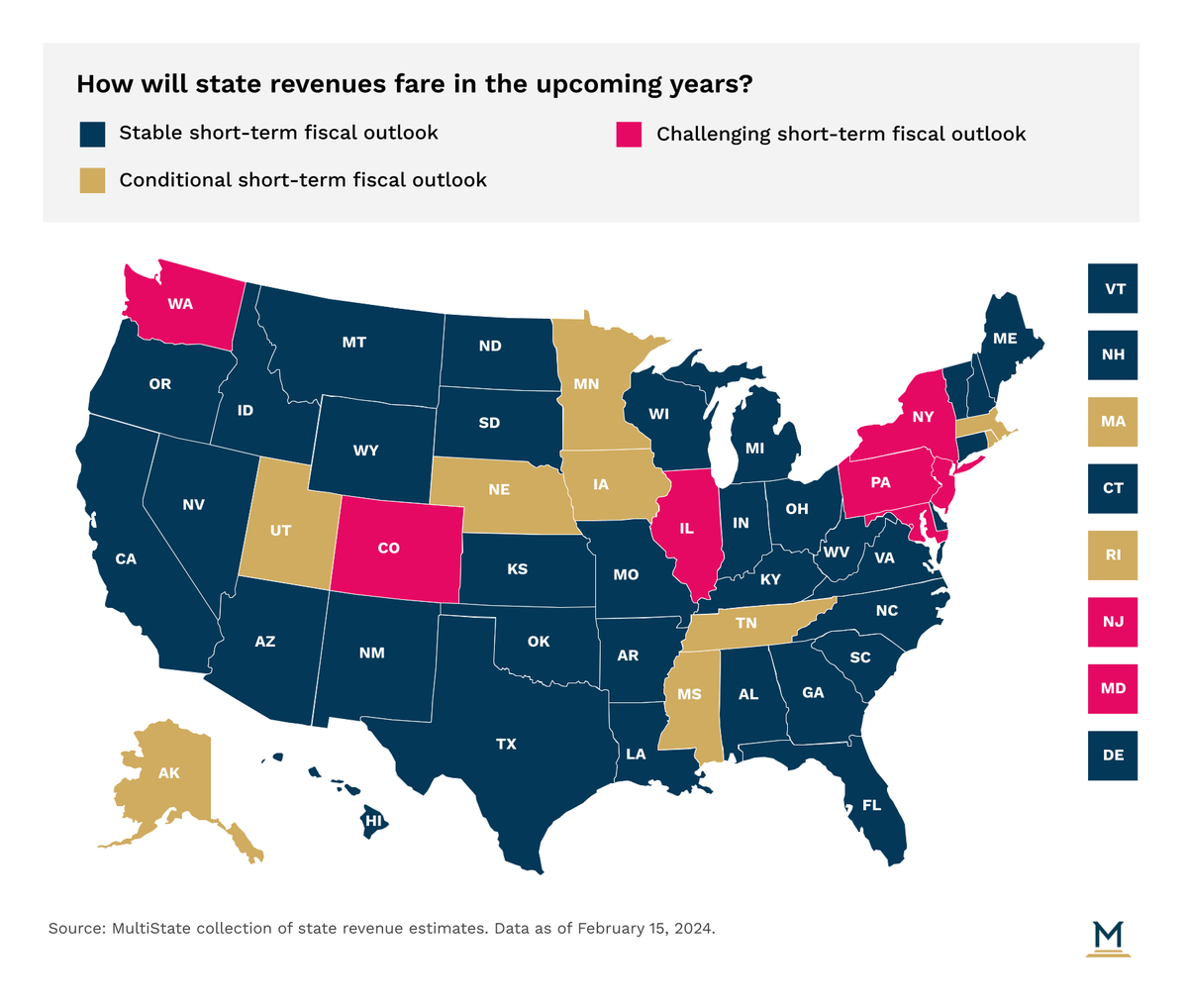

Several times a year, our tax team does a survey of each state’s short-term fiscal outlook to determine if a state's revenues are relatively stable, or if it will likely face short-term fiscal challenges. A state’s fiscal picture is a major policy driver, so it’s important for state government affairs professionals to keep an eye on state fiscal health. We have three “grades” for states: a stable short-term fiscal outlook, a challenging outlook, or a conditional outlook, which means a state’s revenue health could go either way, depending on certain current extenuating circumstances.

February is a slower month for taxes in most states. The onslaught of bill introductions has waned, and states that don't adjourn until later in the spring or summer are waiting for new revenue forecasts before really getting down to budget business. At this time, the majority of states have a stable short-term fiscal outlook (dark blue on the map below), while seven states have a challenging fiscal outlook (pink on the map — Colorado, Illinois, Maryland, New Jersey, New York, Pennsylvania, and Washington). Nine states have a conditional outlook (gold on the map).

Directionally, not much has changed this month since our update last month. Notably, California has moved from conditional to stable for now given that California's revenue picture has improved markedly over the past several months. General Fund revenues are forecast to exceed budgeted revenues by 2.7% ($16+ billion) (however, if we see another round of overspending or deterioration in equities markets, California could be downgraded).

We've downgraded Mississippi due to a drop in tax receipts. Many Republican-led states which had been looking to eliminate (personal) income taxes have begun to exercise more caution in the wake of softening revenues (which are mainly a result of prior tax cuts). The states that still give us greatest concern from the perspective of potential significant business tax increases this year are unchanged: Maryland, Illinois, New York, and New Jersey. There are others we're watching closely — like Washington State — but Washington Governor Ferguson (D) is putting budget reductions at the forefront, at least for now.

A big caveat here: we’ve all read the news regarding recent uncertainty surrounding federal funding to the states. The Trump Administration's aggressive approach to cutting state aid will certainly impact the fiscal stability of states going forward. Maryland and Missouri have voiced concerns over budget shortfalls if federal aid is cut off. For instance, Todd Richardson, Missouri’s director for the state’s health insurance program, warns that the state could potentially be on the hook for hundreds of millions of dollars in Medicaid costs. Likewise, Maryland, which is already facing a budget problem, is bracing to have to cut an additional $500 million due to federal aid reduction.

Tax policy can be one of the most challenging areas for government affairs executives. MultiState’s team understands the issues, knows the key players, and helps you effectively navigate and engage. We offer a customized, strategic solution to help you develop and execute a proactive multistate tax legislative agenda. Learn more about our Tax Policy Practice.

April 8, 2025 | Liz Malm

April 8, 2025 | Andrew Jones

February 28, 2025 | Bill Kramer